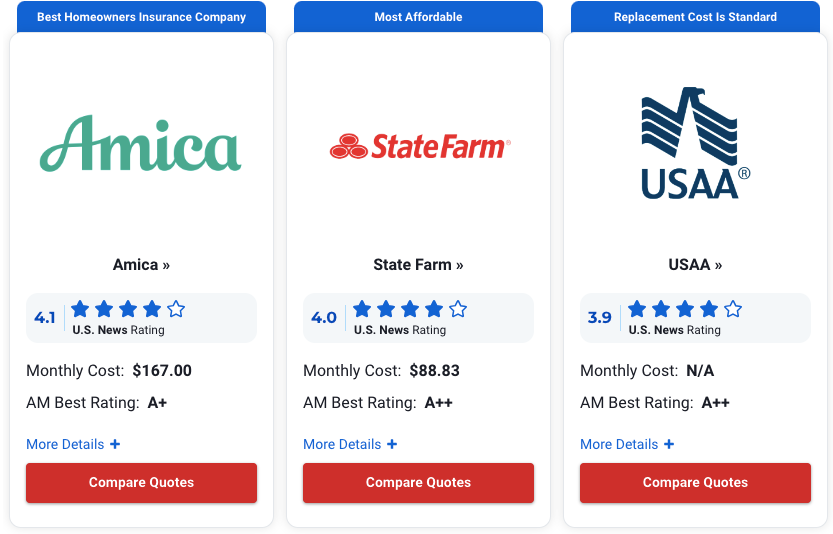

Best Home Owners Insurance Company: After analyzing over 10 homeowners insurance companies and 15 insurance companies, the best homeowners insurance company was Amica. Our review evaluates key factors for choosing a homeowners insurance company, including standard cost, dwelling and structure coverage, identity theft protection, valuables coverage, and available discounts.

Homeowners insurance protects the largest investment many people make in their lives, their homes, and can help pay for damages caused by fire, theft, severe storms, or lawsuits if someone is injured on the premises. This is why choosing the right insurance company and homeowners insurance is so important.

Key Takeaways.

Amica is #1 in our ratings. Unlike other insurance companies, Amica offers two types of homeowners insurance policies that provide different levels of coverage. State Farm, the second-ranked insurer, offers the lowest premiums, on average, of the insurers we analyzed.

Key Takeaways.

Amica offers two levels of coverage: standard choice and platinum choice.

As a mutual insurer, Amica also offers some policies that pay dividends.

About Amica

Amica is No. 1 on the 2023 Best Homeowners Insurance Companies list, along with American Family Insurance. Based in Lincoln, Rhode Island, Amica was founded in 1907 as Automobile Mutual Insurance Company of America. In addition to homeowners insurance, Amica today offers a variety of insurance products, including auto, life, pet, renters, small business, and retirement annuities.

Amica Review.

Ranked #1 in our 2023 Best Home Insurance Companies, Amica offers a wealth of coverage options and ways to save on homeowners insurance premiums.

Amica’s Standard Choice policy provides coverage for the dwelling and other structures on the property, personal belongings, and the cost of temporary housing in the event of damage that renders the home temporarily uninhabitable. Options also include water backup coverage and protection against damage to computer equipment.

The Platinum Choice policy includes all the coverage of the standard policy, plus additional features. These include expanded coverage for repairs and rebuilding, as well as expanded coverage for certain types of property, such as jewelry. Other features include coverage for credit card theft and expanded coverage for damage to business property.

Amica offers both payout and non-payout policies. The dividend plan, which is not available in California, Florida, Missouri, or North Carolina, returns a percentage of the premium to the policyholder. Other ways to save with Amica’s policies include bundling homeowners insurance with auto or other insurance, discounts based on customer loyalty, and discounts based on safety features such as sprinkler systems.

Amica’s monthly premium is $167, according to the sample policy.

The company has an A+ rating from independent rating agency AM Best. The company’s homeowners insurance is not available in Alaska and Hawaii.

Conclusion.

Amica offers Standard Choice homeowners insurance, which includes the most common coverage types and several add-ons, while Platinum Choice policies offer additional features and options. Dividend policies and discounts offer the opportunity to save on premiums, and customers can obtain quotes online and access important information.

Popular Homeowners Insurance Companies

What types of homeowners insurance does Amica offer?

Amica offers two mortgage holders insurance contracts: Standard Decision Home Inclusion and Platinum Decision Home Inclusion.Both policies are available with a dividend option. Please note that coverage varies by policy and state.

Standard Choice.

This policy provides basic coverage for your home:

Dwelling

This coverage pays if the structure of the house (including accessory structures) is damaged and requires repair or reconstruction after a covered claim.

Other Structures.

This coverage pays for damage to structures on the property that are not attached to the dwelling, such as fences, sheds, barns, etc.

Personal Property

This coverage pays if clothing, furniture, appliances, or other items are damaged by a covered loss.

Loss of Use

This coverage, also called Additional Living Expense (ALE), pays to temporarily house you and your family if you are unable to live in your home after damage caused by a covered peril. It also pays for expenses such as meals out and lodging for your pets.

Liability.

If you or someone in your household is legally liable for damages to another person’s property or injury to another person, this coverage pays your legal expenses.

Platinum Choice.

Platinum Choice coverage provides the basic coverage of the Standard Plan plus coverage that may be purchased a la carte if you choose Standard Choice coverage.

Residential Replacement Cost

This coverage provides up to a 30% increase in dwelling coverage to repair or replace the dwelling after a covered loss has occurred.

Personal Property Replacement Expense

If electronic equipment, furniture, clothing, or other items need to be replaced after a covered claim, we will replace them with new items without regard to depreciation.

Liability and Medical Expense Coverage

This coverage increases liability limits up to $500,000 and guest medical expenses up to $5,000.

Valuables Extension Coverage

Expensive items such as antiques, artwork, jewelry, and other valuable items are covered with the Platinum Choice package with increased limits.

Business Property Coverage

If you have business property in your home, this coverage pays up to $5,000 for damages. If you have damage to your business property outside of your residence, this coverage is reduced to $2,000.

Water Backflow/Drainage Pipe Overflow

This coverage pays for damage caused by a sump pump failure or overflow, or by water or sewage pipes backing up into your home’s drains.

Special Computer Coverage

This coverage pays for damage to electronic equipment such as televisions, tablets, laptops, and smart phones caused by water, heat, or power surges, with broader limits.

Credit Card Coverage

This coverage pays up to $5,000 if your credit card is stolen or fraudulently charged.

Damage Assessment Plan

This coverage applies to residents of condominiums and gated communities who suffer damage to common areas.

Dividends

Amica also offers a dividend plan in some states, returning 5% to 20% of your annual premium each year as a dividend. This dividend can be mailed as a check, deposited directly into your bank account, or applied to the following year’s premium. Standard policies are traditional policies and do not receive dividends.

How much does Amica’s homeowners insurance cost?

Amica’s monthly premium is $167 for a 2,400 square foot townhouse in Naperville, Illinois, with a sample coverage limit of $500,000. Your cost will depend on the specific features of your home and your demographics.

What homeowners insurance discounts does Amica offer?

Amica policyholders are eligible for the following homeowners insurance discounts

- Claims Free. This discount applies if you have not had a claim in the last 3 years.

- E-Rebate. Policyholders who pursue electronic archives are qualified for this markdown.Autopay. Policyholders who automatically pay their premiums are eligible for this discount.

- Loyalty. Subscribers who have been with Amica for at least two years are eligible for this discount.

- Multi-Line. Bundle your homeowners insurance with auto, condo, life, umbrella, or renter’s insurance and receive up to a 30% discount.

- Alarm Systems. Homes with burglar alarms, fire alarms, or automatic sprinkler systems qualify for this discount.

- Automatic Detection Systems. Homes with water leak detection systems, temperature monitoring systems, or gas leak detection systems qualify for this discount.

- New/Renovated Home Credit. This credit applies to newly constructed or newly remodeled homes.

- Discount rates and availability of discounts vary by state. Please consult your Amica representative to determine which discounts apply and how much you could save.

How to Purchase Amica Homeowners Insurance

Amica insurance can be purchased online, by phone, or in person with an Amica representative. To enroll in Amica’s homeowners insurance, follow these steps

1. prepare your information

Before you begin the policy process, have your information ready. You will need personal information such as your name, date of birth, social security number, and past insurance history including claims history and company information. You will also need various home details such as address, age, building materials, roof type and age, age of utility systems (plumbing, heating, etc.), number of rooms, number of bathrooms, etc.

2. get an estimate

Amica offers several ways to get a quote. You can call, get an online estimate, or get an estimate with an Amica representative. Having all of your information ready will make this process more efficient.

3. determine your coverage needs.

If you are not sure which insurance policy is best for you or what coverage you need, it may be best to discuss this with an Amica representative over the phone or in person. Your representative can help you decide which insurance and coverage is best for your home and personal needs.

4. selecting and purchasing insurance

Once you have selected the type of insurance and coverage, it is time to purchase your insurance policy. Amica will direct you on how best to finalize your insurance policy.

How do I request homeowners insurance from Amica?

You can file a claim for homeowners insurance through Amica’s website via online chat, mobile app, or phone.

When filing a claim, please follow these steps

- If you are involved in a crime, such as theft or vandalism, first contact the police and file a damage report.

- Contact Amica as soon as possible.

- Use the chat feature to speak with a representative online, on the mobile app, or by phone to file aninsurance claim.

- If possible, document the accident with photos or video.

- Repair any damage that may have occurred to your home and keep receipts.

- Amica will assign a claims representative and may send an adjuster to check for damage.

Amica vs. Competitors

Amica Compared to State Farm

Amica, the #1 insurer in our ratings, does not sell homeowners insurance in Hawaii and Alaska. State Farm, our second-ranked insurer, does not sell homeowners insurance in California, Massachusetts, or Rhode Island.

In addition to the most common coverage, both companies offer a variety of options and opportunities to save on premiums by bundling policies or taking advantage of other discounts.

Amica and State Farm’s insurance samples include standard coverage for the policyholder’s home, as well as other common coverages such as personal property and liability coverage. Both insurers also offer optional protection against water backup losses.

Amica outperforms State Farm in the number of common discounts available. Policyholders of both companies can receive discounts and save on premiums by installing alarms and other safety and security related devices. The same is true for claims-free discounts and customer loyalty discounts. But in addition, Amica offers discounts for insuring newly constructed or remodeled homes and “e-discounts” for agreeing to receive policy documents and invoices electronically.

Amica is more expensive for sample policies. The monthly premium is $89 for State Farm versus $167 for Amica.

AM Best’s rating is A+ for Amica compared to State Farm’s A++.

For more information, see our review of State Farm.

Amica vs. Allstate.

Allstate, ranked No. 3 in our ranking of the best homeowners insurers in 2023, is one of only two insurers to offer green-upgraded coverage.

This is one type of coverage that No. 1-ranked Amica does not offer and is one of the differences between the two companies in terms of the types of coverage offered.

In most other respects, the insurers’ standard coverage is similar and includes general protections such as dwelling insurance covering the physical structure of the policyholder’s home, personal property and liability coverage. Both companies offer optional coverage for identity theft and water damage. Like the other companies we reviewed, Amica and Allstate’s flood insurance is offered through the National Flood Insurance Program.

Both Amica and Allstate offer discounts for bundling homeowners insurance with other coverage, as well as discounts based on loyalty. Amica offers discounts to policyholders who choose electronic document delivery, while Allstate does not. Allstate offers discounts for consistent payment history, but Amica does not.

Neither option offers homeowners insurance in all 50 states. Amica does not offer insurance in Alaska and Hawaii, and Allstate does not offer insurance in California.

According to the sample policies, Allstate’s is more expensive, with a monthly rate of $264. Amica’s sample premium is $167 per month. Both Amica and Allstate have an A+ rating from AM Best.

Frequently Asked Questions.

What does Amica’s homeowners insurance policy not cover?

Standard homeowners insurance does not cover earthquake, flood, identity theft, expensive possessions over a certain limit, water backup, or replacement of dwelling or personal property. All of these coverages can be purchased for an additional fee, and some are automatically included in Platinum Choice Home Coverage policies.

Does Amica’s home insurance policy cover mold?

Mold coverage varies by state and cause and is subject to insurance limitations.

Does Amica homeowners insurance cover flood damage?

Flood insurance is not included in standard policies. It also does not include backups due to clogged drains or sump pump failure. These coverages are optional. Please contact your representative for more information.

Does Amica’s homeowners insurance cover termites?

Termite damage, typically caused by lack of maintenance, is not covered by homeowners insurance.

Does Amica’s homeowners insurance policy cover theft?

Theft coverage is included in the standard policy, but additional coverage may be required for valuables.

Does Amica’s homeowners insurance cover roof leaks?

If your roof is damaged by weather that is covered, coverage is provided for roof repairs. Leaks due to lack of maintenance are not covered.

Damage caused by roof leaks may be covered. Please check with your insurance company as specific policies and state regulations may have restrictions.

Does Amica’s homeowners insurance policy cover tree damage?

Damage caused by a tree that falls due to wind is covered as part of the standard Amica homeowners policy.

Does Amica’s homeowners insurance policy cover dog bites?

If a visitor is bitten by a light dog, the standard policy may cover the bite, but additional coverage is available for larger or more aggressive dogs.

Does Amica’s homeowners insurance cover personal liability?

Standard policies include medical and liability coverage for guest injuries. If you are using a pool, trampoline, or other potentially increased hazard, we recommend an optional level of coverage. Please consult with your insurance company representative.

Does Amica’s homeowners insurance policy cover fire?

Fire insurance is included in Amica’s standard policy.

Does Amica’s homeowners insurance cover insect damage?

Bug harm is commonly viewed as a support issue and isn’t covered.Reasons to Trust: Survey of 15 Homeowners Insurance Companies

U.S. News & World Report ranks the “best hospitals,” “best colleges,” and “best cars” to help guide you in making life’s most complex decisions The 360 Review team takes this unprejudiced way to deal with assessing the items you utilize consistently.

To build our ratings, we surveyed more than 15 homeowners insurance companies and insurance agents and analyzed 11 reviews from both professionals and consumers.The 360 Review Team does not receive samples, gifts, or loans of the products or services we review. All sample products provided for review are donated after the review. We also maintain an independent business team that does not influence our methodology or recommendations.