Lower Health Insurance In USA : Take Life’s Twists and Turns with Health Insurance Open Enrollment for 2024 Open Enrollment (November 1 – January 15) is the period during which nearly all Colorado residents can purchase a private health insurance plan Outside of the Open Enrollment period. Colorado residents who experience a Qualifying Life Change Event will have 60 days to purchase or change their insurance plan.

More financial assistance than ever before

Whether you are new to Colorado health insurance or you have previously enrolled and did not qualify for financial assistance to pay your health insurance premiums at the time, it is worth taking a second look. Here’s what you need to know:

– There is no income limit for receiving financial assistance, and Colorado residents of most income brackets are eligible for reduced premiums.

– People with incomes below a certain amount can enroll in a plan with a $0 premium.

– Families with employer health insurance may also qualify for financial assistance through the Marketplace.

– Colorado residents with incomes below a certain amount may qualify for even more cost-sharing reductions than in previous years.

- Connect for Health Colorado is the official Marketplace where you can

- Compare plans from multiple health insurance companies online

- Buy and compare plans from multiple health insurance companies online.

- Buy and compare plans from multiple health insurance companies online.

- Apply for financial assistance to lower your health insurance premiums.

Accredited Professionals

Can direct you through the enlistment interaction, offer guidance, and answer your inquiries.

What is the Colorado Options Plan?

How do I start shopping?

- Compare plans and estimate your financial assistance before you shop Icon Number 1.

- Use our quick and easy online tool to compare plans before you start applying:

- Covered doctors and medications

- Monthly premiums

- Possible financial assistance

- Estimated total annual medical costs, and more.

- View 2024 Medical Insurance Plans and Pricing “

- Consider including Icon #2 Dental and Vision Plans.

Dental and vision health is an important part of your overall physical health. With a Dental & Vision Plan, you can protect your eyes and teeth, too.

Learn About Dental & Vision Plans “

Talk with an Icon Number 3 Certified Expert to choose a plan.

Get all your health insurance questions answered and advice from a Colorado Certified Expert before you choose a plan.

Health insurance pays for your medical bills when you need it most and protects you from financial liability. We can help you lower your monthly costs so you know you have a plan to back you up.

What do I need to apply?

Names and dates of birth of everybody in your family

Address. If someone in your household (the household you list on your tax return) has a separate address, we need that address as well.

Social Security Number. Provide the Social Security number of the person applying for coverage. If left blank, you may be asked to provide more information at a later date.

Immigration Documentation Information. Noncitizens applying for insurance may be asked to provide information from their immigration documents.

How to file taxes. You may be asked about your filing status and any dependents on your taxes.

Sources of Income. If you are applying for savings, you will be asked to enter the employers and income information for everyone in your household.

More financial assistance available than ever before!

Whether you are hearing about us for the first time or you have used us before and did not qualify for financial assistance in paying your health insurance premiums at the time, it is worth taking a look at us again. Here’s what you need to know:

– There is no income limit for receiving financial assistance, and Colorado residents of most income brackets are eligible for reduced premiums.

– People with incomes below a certain amount can enroll in a plan with a $0 premium.

– Families with employer health insurance may also qualify for financial assistance through the Marketplace.

– Colorado residents with incomes below a certain amount may qualify for even more cost-sharing reductions than in previous years.

There are two types of financial assistance for which you may qualify:

Financial assistance icon premium tax credits that lower your monthly premiums

Cost-sharing reductions that provide discounts on medical bills when you go to the doctor, pick up a prescription, or have to pay a deductible.

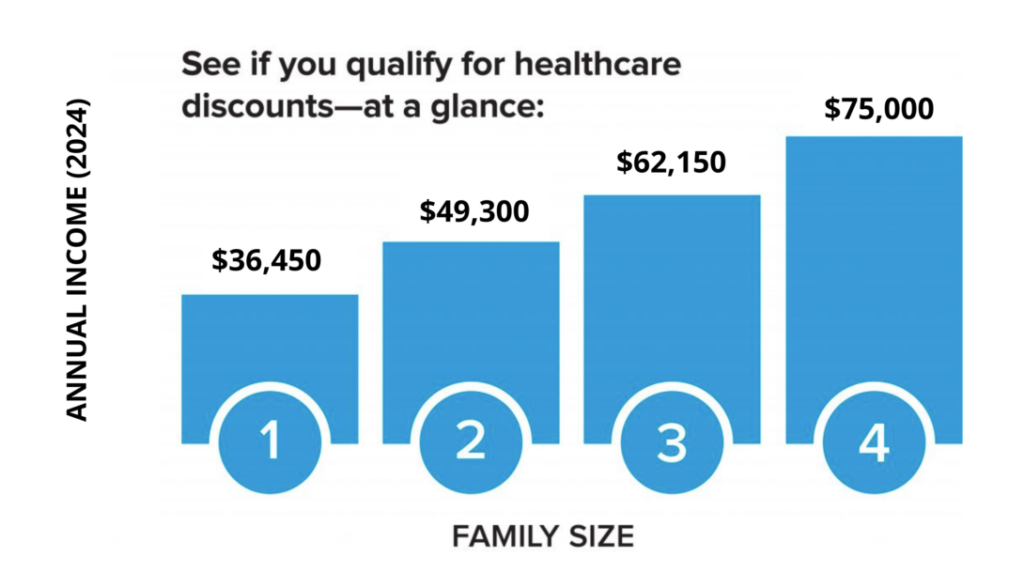

Depending on your income range and the number of people in your household, you may qualify for lower monthly premiums or both lower monthly premiums and cost-sharing reductions.

Lower Monthly Premiums (Advanced Premium Tax Credit)

Financial assistance available to lower monthly premiums is called the premium tax credit. Each family is different. You may be eligible for financial assistance based on your family’s unique needs and circumstances, including

- Number of family members

- Your geographic area of residence

- Estimated annual family income

- Financial assistance is available in two ways

- Apply savings in advance to lower monthly premiums.

- Wait until tax filing to add premium tax credits to your tax refund.

Medical Expense Discounts (Reduced Cost Coverage)

If you qualify for lower out-of-pocket costs and enroll in a silver plan, you automatically receive a medical expense discount when you see a doctor or get a prescription. Plans with medical expense discounts also have lower out-of-pocket maximums. These medical cost discounts are called Cost-Sharing Reductions.

Lower your monthly premiums

Connect for Health Colorado is the only place you can apply for financial assistance to lower your health insurance premiums. Financial assistance to lower your monthly payments is called the Premium Tax Credit. You can enroll in health insurance during the Open Enrollment period (November 1 – January 15).

Unprecedented financial assistance

Whether you are hearing about our association for the first time or you have joined us before and did not qualify for financial assistance with paying your health insurance premiums at that time, it is worth looking into our association now. Here’s what you need to know:

– There is no income limit for receiving financial assistance, and Colorado residents of most income brackets are eligible for reduced premiums.

– People with incomes below a certain amount can enroll in a plan with a $0 premium.

– Families with employer health insurance may also qualify for financial assistance through the Marketplace.

– Colorado residents with incomes below a certain amount may qualify for even more cost-sharing reductions than in previous years.

Tips for Managing Financial Assistance

You should only receive as much financial assistance as you need each month.

At the time of application, you can decide whether to use some or all of the financial assistance you qualify for up front or wait to take the deduction on your tax return.

Why would you want to do so? To avoid the hassle of repayment.

Here’s why: tax credits offered through the government are only available if you apply for and purchase them through Connect for Health Colorad

When you file your federal income taxes, the IRS will recheck to see if you received the correct amount of tax credit based on your actual income and family size for the year. Additionally, some families may have calculated their taxes correctly and received more tax credits, while others may have to pay back taxes if their estimates are incorrect.

If your income is likely to increase or if you plan to move throughout the year, it is best to receive only a portion of your monthly assistance payment or to receive it all at once as a tax credit when you file your tax return.

After registering, log in and report your income changes for the year.

By reporting changes to Connect for Health Colorado during the year, you can make any necessary adjustments throughout the year and reduce the risk of having to repay some or all of the financial assistance you received.

Get advice from Connect for Health Colorado’s statewide network of certified professionals.”

Who Cannot Receive Financial Assistance?

In Colorado, if you are offered affordable health insurance, you do not have to purchase that insurance to receive financial assistance from Connect for Health Colorado. Examples include:

- Health First Colorado (Medicaid)

- Employer

- Medicare (Medicaid)

- TRICARE (TRICARE)

- Child Health Plan Plus (CHP+) Program

- * This rundown does exclude all qualification measures.

Because of the availability of other affordable coverage, individuals who do not qualify for financial assistance may also be eligible for health care coverage through Connect for Health Colorado, but at the full rate when applying through Connect for Health Colorado, Be sure to mention that you have other medical insurance available.

Can I use this financial assistance with any health plan?

Yes, in almost all cases. You can use your financial assistance to purchase any health plan sold through Connect for Health Colorado. The primary exception is for energetic adults more youthful than 30. Young adults are offered a special Catastrophic plan, but are not eligible for financial assistance to purchase a Catastrophic plan.

How is the amount determined?

The amount of financial assistance you are eligible for is based on your family-specific circumstances, including your income, age, number of family members, where you live, and estimated family income.

How is it used?

When you apply through Connect for Health Colorado, you enter your personal and financial information to find out how much financial assistance you are eligible for. When you first apply, you can choose to use all, some, or none of your tax credits to lower your monthly premiums. Your premiums will automatically be reduced to the appropriate amount.

What if my income changes every month?

When you file your tax return at the end of the year, the IRS will recheck to see if you received the correct amount of tax credits based on your actual income and family size for the year. The application process may result in some families receiving more tax credits, while others may have to take tax credits that they did not receive if their estimates were inaccurate.

IMPORTANT: If you have a significant change in income, you must report the change in income to Connect for Health Colorado and have your monthly premium adjusted.

What if my job offers health insurance or I have health insurance from another source?

If you are able to obtain health insurance from another source that is affordable and meets certain benefit standards, you will most likely not be eligible for financial assistance.

If you have a health insurance offer from your job, you most likely will not qualify for financial assistance to lower your monthly premiums through Connect for Health Colorado. However, if someone in your family has the option to enroll in your workplace health insurance, you may qualify for financial assistance through our Marketplace and are encouraged to apply.

What occurs assuming my family size or pay changes?If there is a change in the number of people in your family, you must report the change to Connect for Health Colorado. If the number of family members changes, you will be eligible for a special enrollment period.

If your income changes during the year, you may be able to change to a plan with a health care discount, which may reduce your out-of-pocket expenses for doctor visits.

The Commercial center offers different designs to browse Let’s explore some of the differences to keep in mind when considering which plan is right for you.

Medical Insurance Companies

Connect for Health Colorado has partnered with the following health insurance companies to provide health care to Colorado residents: Anthem Blue Cross Blue Shield, Cigna Healthcare, Denver Health Medical Plan, Kaiser Permanente, Rough Mountain Wellbeing Plans, and Select Wellbeing. Plans available through each carrier vary by county.

Health Plan Types

Colorado Optional Plans.

These plans are designed to provide greater cost/benefit transparency and lower costs for many services.

Benefits, co-pays, deductibles, and out-of-pocket limits are the same for all Colorado Option plans within a particular metal tier (Bronze, Silver, Gold) for all health insurance companies.

This makes it easier to compare plans and know how much to pay for the most common services.

HMO IconHMO Plans (Health Maintenance Organization)

– Requires you to choose an in-network primary care physician (PCP) and usually requires a referral to an in-network specialist. EPO IconEPO Plans (Exclusive Provider Organization) – Usually allows you to see a specialist without a referral.

If you want to be sure that a particular doctor or hospital is covered, you should choose a type of insurance plan that includes that doctor or hospital in its network. Insurance companies may offer only one type of medical insurance plan, or they may offer more than one, so be sure to double-check to make sure you have the correct insurance company and plan type when you sign up.

Bronze, Silver, and Gold Plans

Health insurance plans are divided into three levels, and you can see at a glance how your plan typically pays for itself: when you sign up through Connect for Health Colorado, you choose a Bronze, Silver, or Gold plan. Insurance Levels Metal Percentage

What do I need to sign up?

Icon Number 1Basic Information Name and date of birth of each person in your household.

Icon Number 2Home Address. If your household (the household listed on your tax return) has a separate address, that address is also required.

Icon Number 3 Social Security Number. Enter each person’s Social Security number. If left blank, you may be asked for more information at a later date.

Icon #4 Immigration Document Information. Are any of the applicants legal immigrants? Assuming this is the case, you will be approached to give data from movement archives.

Icon #5Tax Filing Method. If you are filing federal income tax, you may be asked about your filing status and dependents. Icon #6 Income Information. Enter work and income information for all household members.

How do I verify that I have insurance?

Colorado health insurance companies will mail claims forms, plan materials, and ID cards to all new enrollees, so watch your mailbox. Once you have applied through Connect for Health Colorado, it takes approximately 10 business days for your selected insurance company to receive and process your application.

If you applied for coverage through Connect for Health Colorado at the end of the month, or if the enrollment process was not successful, your selected insurance company may not yet know that you have joined their plan. If necessary, we will work with your insurer to resolve the issue as quickly as possible and finalize your enrollment.

Please call your insurance company to confirm your coverage or for any other questions you may have, the phone numbers for the insurance companies that work with Connect for Health Colorado are listed below.

When does my coverage begin?

In most cases, if you enroll in health insurance during a special enrollment period, your coverage will begin on the first of the month following your plan selection. Read More “

- For example.

- For example Insurance start date

- May 26 June 1

- July 17 August 1

- August 4 September 1

Normally, during the Open Enrollment period (November 1 – January 15), if you complete the enrollment process by the 15th of the current month, your coverage will begin on the 1st of the following month; if you complete the enrollment process after the 15th, your coverage will begin on the 1st of the following month.

What if I don’t have an ID card but need a doctor’s appointment or prescription?

If you need service, there is no need to wait; if you do not have your ID card, please contact the insurer’s customer service team. They may be able to provide you with a membership number, temporary ID card, or online ID card. A list of insurance companies and their customer service phone numbers are listed below.

If you receive treatment after the start of your coverage period and before you receive your ID card or welcome materials, you must pay for your treatment on the spot.

How do I pay my bill?

- Please pay your bill by the due date to ensure coverage on the date selected.

- You may have made your initial payment when you enrolled. If so, your insurance company is currently in the process of sending you enrollment materials.

- If you have chosen the option to pay your initial premium by check or money order, please be sure to pick up your initial invoice and pay it by the due date.

- If you paid your premium by credit card and did not receive your ID card in early January, please contact your insurance company.

- Please remember: