Who Needs Renters Insurance?

Best Renters Insurance: Anyone who rents an apartment, condo, or townhome should seriously consider purchasing renters insurance. Renters insurance provides coverage for damage or destruction of the renter’s personal property due to trespassing, storms, or other events specified in the policy.

In addition, renter’s insurance provides coverage for personal liability and medical expenses if a guest is invited to the property and is injured. Finally, if you have to move out of your room due to a fire or other catastrophic event, it will reimburse you for extra living expenses, such as hotel and dining out expenses.

Unlike other types of insurance, renters insurance is relatively simple. However, there are subtle nuances to the policy and the insurance company you choose. Below, we list the top-rated renters insurance companies in 2023 and explain in detail how renters insurance works.

How to Choose the Best Renters Insurance

There are several steps to take when choosing renters insurance. They include the following

Decide what you want to cover. The Insurance Information Institute explains that there are three basic types of coverage included in most renters policies: personal effects, liability, and additional living expenses.

Consider your situation and decide which of these you want to cover:

Personal property includes clothing, bedding, sports equipment, hobbies, small appliances not attached to the rental property, and other possessions stored in the room.

The liability coverage associated with renter’s insurance will pay for legal fees and medical expenses incurred if a guest is injured in the unit, as well as protect you from claims of negligence outside the unit.

Additional Living Expense Coverage pays for hotel bills, restaurant meals, and other expenses above and beyond normal living expenses.

Become familiar with tenants protection inclusion choices in our “What Does Leaseholders Protection Cover?” guide. Determine the Amount of Renters Insurance You Need To figure out the amount of renters insurance you need, take an inventory of all your personal property. Walk through each room in your home and write down everything you own, including items tucked away out of sight, such as in bedroom closets.

Make sure you have adequate coverage because you may have to replace all of these items after a major disaster. Particularly valuable items, such as expensive jewelry, may require supplemental or additional insurance. For premiums, choose either replacement value insurance or actual cash value insurance.

Replacement value insurance has a slightly higher premium, but it covers the cost of replacing a lost or damaged item with a new equivalent item, without deducting depreciation. In contrast, actual cash value insurance covers only what those items were worth in the condition in which they were used. For certain types of property, especially items that depreciate rapidly, such as electronic equipment, actual cash value insurance would leave insufficient funds to purchase new items.

Choose a renter’s insurance company When choosing an insurance company, look for companies that use their own agents, independent agents who refer clients to multiple insurance companies, or companies that sell policies directly online or over the phone. Family, friends, and real estate agents can provide valuable recommendations; ask for quotes from three or more companies, but don’t just look at price. Customer service and a strong financial rating from an agency like AM Best are equally important, if not more so.

Choose insurance. Finally, choose insurance that provides adequate personal effects and liability coverage. To avoid unpleasant surprises later, read the fine print and understand all the terms and conditions of the policy, including what the insurance will and will not cover. Finally, consider adding coverage for local-specific disasters, such as floods and earthquakes, that are not covered by standard insurance policies.

For more information, see How to Purchase Renters Insurance.

Should renters insurance and auto insurance be bundled?

Whether you decide to bundle renters and auto insurance is up to you, but bundling is not always the cheapest option. However, bundling is not always the cheapest option. Our ratings indicate that many insurers offer the option to bundle these two policies, which may result in lower premiums. However, the actual savings will vary depending on the bundled coverage.

Similar discounts may be available for other types of insurance. For example, Allstate may bundle renter’s insurance with term life or auto insurance, while Nationwide may bundle renter’s insurance with motorcycle insurance.

You could save additional by buying individual arrangements from independent organizations. For more information, see How to Bundle Renter’s Insurance and Auto Insurance.

What Does Renters Insurance Cover?

If you are a renter, your landlord’s insurance policy protects the building you live in, but not your household contents.In case of a mishap, your property manager can’t be considered monetarily liable for any harm to your things. Renters insurance, like homeowners insurance, is designed to protect the household contents of your residence.

A typical renter’s insurance policy will also cover the following

Living expenses. Living expenses. Loss of use coverage helps cover additional living expenses that arise as a result of damage to your home. For example, if a fire breaks out in the building and your apartment becomes uninhabitable, loss of use coverage may help pay for a hotel room for you to stay in. Personal Liability. Personal liability coverage applies if someone is injured or their property is damaged and you are held liable. Medical Expenses of Guests. Your renter’s insurance policy may also cover payment of your guests’ medical bills and your legal defense if the injured party takes you to court.

The amount your insurance company will pay in such cases depends on the renter’s insurance policy you have. Often the maximum amount of coverage depends on the premium (the amount you pay each month) and the deductible (the amount you must pay out-of-pocket before the insurance will cover you).

When purchasing renter insurance, do not focus solely on price. Even the company with the lowest premium may not have the coverage you need or the best customer service. The Consumer Federation of America notes that good customer service is especially important because it makes the claims process easier and more pleasant.

For more information, see How Renters Insurance Works.

Do you need renters insurance?

There are several reasons you may want to consider renters insurance.

Landlord Requirements.

Some landlords and rental agencies require tenants to maintain renters insurance. Check your rental agreement or contact your current or potential future landlord to determine if insurance is required.

Coverage for belongings.

Your landlord likely already has insurance to protect the building, but that insurance will not cover you in the event of theft, fire, water damage, or other events that could damage your possessions. Renters insurance can help protect your valuables and everyday essentials such as clothing, laptops, and appliances.

Liability coverage.

Most renters insurance policies include liability coverage. If someone is injured or their property is damaged and you are found legally liable, insurance can help pay for repairs, replacement of items, and medical bills.

Post-disaster financial assistance.

Renters insurance typically includes “loss of use” coverage, which can help pay for hotel and other necessary expenses (such as daily meals) if you lose your residence due to a covered disaster.

Worried about the cost? Check with an affordable renters insurance company.

Do college students need renters insurance?

According to the National Center for Education Statistics, burglaries accounted for 33% of on-campus crime in 2019. Renters insurance covers the cost of repairing or replacing personal property after a covered loss has occurred and living expenses if you need to find a new place to live after a covered loss makes your residence uninhabitable. It also covers liability if you accidentally damage the property or injure someone on the property.

Normal homeowner’s insurance policies generally provide small coverage for off-premises belongings, such as those in dorm rooms. However, off-campus apartments and homes are not likely to be covered and will require a separate renter’s insurance policy.

According to the Insurance Information Institute (III), electronic devices such as cell phones and computers may be covered by separate policies. Students may also be eligible for a discount on their auto insurance premiums if they leave their car at home while they are in college.

For more information on how renters insurance works, see How to Request Renters Insurance.

What are the premiums for renters insurance?

Our ratings range from $13.43 to $24.29 per month for premiums. The cost of renters insurance is affected by many factors

- Location of residence

- Type and amount of coverage desired

- Deductible amount

Whether you opt for reinsurance (Replacement-Cost) or a less expensive premium (Actual-Cash-Value).

Whether to add supplemental coverage to insure against natural disasters such as earthquakes or expensive property such as jewelry or artwork.

According to a 2021 study by the National Association of Insurance Commissioners, the average annual cost of renters insurance in 2019 was $174. Some companies offer policies as low as $5 per month. Compared to the average annual premium for homeowners insurance of $1,272 per year, renters insurance is a relative bargain when you consider the cost of replacing personal items or injuring a resident. Our guide, How Much Does Renters Insurance Cost, discusses the cost factors in more detail.

A common way to save money is to bundle renters insurance with auto insurance. See “How to Package Tenants and Collision protection” for more data.

What should I look for in renters insurance?

When purchasing renters insurance, you should look for the following

- The policy must have sufficient coverage for all of your personal property.

- Replacement cost or actual cash value

- Insurance that covers personal liability and additional living expenses

In terms of coverage, you want to make sure that you have enough coverage to reimburse you for personal property damaged in a storm, fire, or other disaster. To do this, create a property inventory by writing down all property you own and its approximate value. Be sure to save receipts, if any. You also want to write down any valuables, such as jewelry or electronics, for which you may need additional coverage.

You also want to make sure that your policy is Replacement Cost or Actual Cash Value. Replacement Cost compensates you for the cost of replacing your property with an equivalent new item. Actual Cash Value compensates only for depreciated value. Used property is not worth as much, so coverage will be lower. Which policy you choose depends on how you balance the risk to your property with the monthly premium payments.

Find out what types of disasters are covered. For example, one insurer’s policy may include coverage for flooding in a standard rental agreement, while another may offer it as an optional add-on or refer you to another insurer.

Finally, examine the policy’s personal liability coverage and additional living expense coverage. Whether you need these coverages depends on how likely it is that guests will be injured on your property and how likely it is that your home will be damaged and you will have to move out.

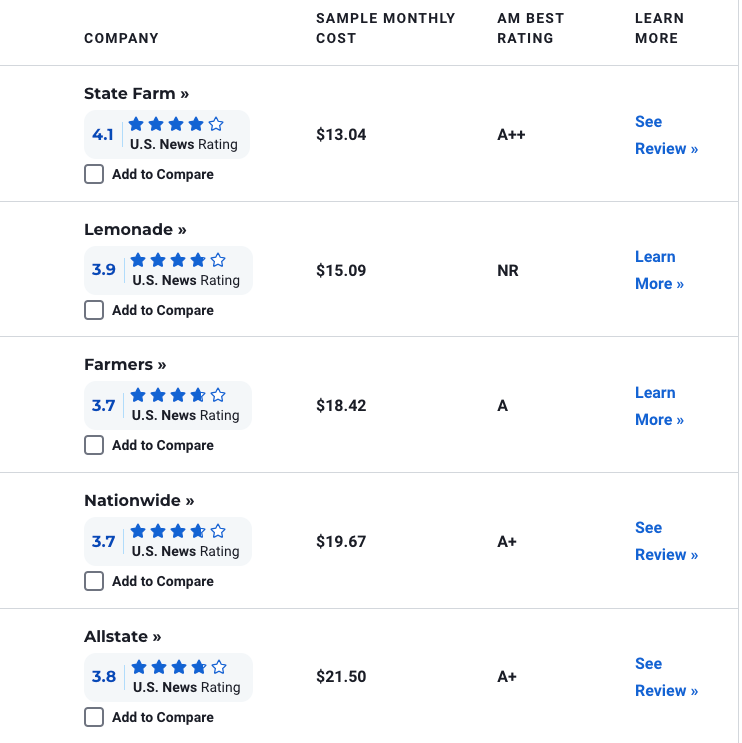

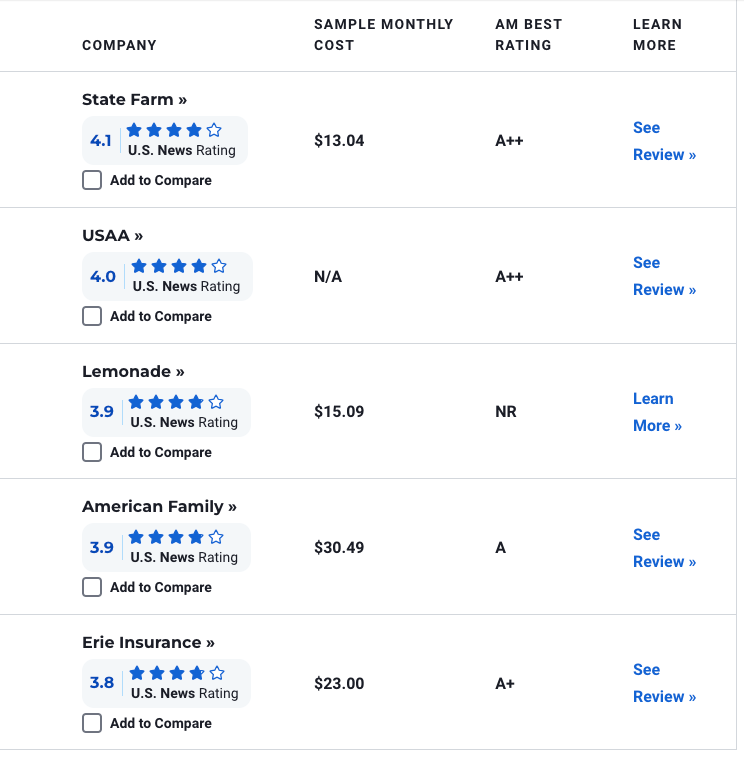

Cheapest Renters Insurance Companies in 2023

Monthly premiums for renters insurance can quickly add up depending on a variety of factors, including the amount of coverage you have and the coverage options you choose. That’s why we are pleased to present our list of the cheapest renters insurance companies in 2023.

This rating is based on a median sample of quotes from companies on our list of Best Renters Insurance Companies in 2023.

How Sample Rates Were Determined

Premiums are based on median quotes in four different cities. The sample unit is a 2-bedroom, 1.5-bathroom unit ranging from 1,000 to 1,999 square feet. Coverage includes $25,000 personal effects, $100,000 liability, $3,000 portable electronics, and $500 deductible.

Compare Best Renters Insurance Companies in 2023

Does renters insurance cover roommates?

Most renters insurance policies do not cover roommates. Therefore, if your roommate’s belongings are damaged or stolen, your insurance will not cover them.

Some insurance companies may allow you to add your roommate to your policy, but this is not always recommended. For example, if a roommate files a claim, it will show up on your claims history, and even though you have added a roommate, your policy coverage limits may not increase.

Consult with your insurance agent or insurer to be fully informed.

360 Methodology for Evaluating Renters Insurance

Below is a 360 approach for researching and analyzing renters insurance.

1. we looked at the companies and products that people are most interested in.

U.S. News analyzed and compared a variety of publicly available data, including Internet search data, to identify the phones Americans are most interested in. As a result, we found 24 insurance companies and agencies that stood out based on the number of consumer searches and surveys, as well as various sources of evaluation information.

The available renter insurance policies were then compared by several criteria, including monthly cost, coverage, discounts, availability of additional coverage, financial strength, and state availability. According to the study, these are the most important criteria for cell phone buyers.

2. based on an analysis of third-party reviews, an objective 360 overall rating was created.

The U.S. News 360 review team applied an unbiased methodology that included input from consumer reviews as well as expert reviews.

The U.S. News scoring methodology is based on a composite analysis of published ratings and reviews from credible third-party professional and consumer review sources. Ratings are not based on U.S. News’ personal opinions or experiences. To calculate the rating.

(a) two types of third-party ratings and reviews were compiled:

Expert Ratings and Reviews. A number of independent renters insurance rating agencies have published their evaluations of renters insurance companies and agencies. We believe that some of these third-party reviews are reputable and well-researched. However, professional raters often make recommendations that contradict one another, and U.S. News believes that consumers benefit most from a comprehensive review and analysis of these opinions and recommendations in an objective, consensus-based manner rather than relying on a single source.

Consumer Ratings and Reviews U.S. News also examined consumer ratings and reviews of car rental insurance companies and agencies. Sources with a sufficient number of quality consumer ratings and reviews were included in the scoring model.

Please note that not all professional and consumer rating sources meet our criteria for objectivity. Therefore, some sources were excluded from the model.

(b) Inputs were standardized to create a common measure.

Data from third-party evaluation sources were collected in a variety of forms, including ratings, recommendations, and praise. Before each third-party data point could be included in the scoring formula, it needed to be standardized so that it could be accurately compared to data points from other review sources. We used the scoring method described below to convert these systems into a comparable scale.

The 360 scoring process first converted each third-party rating to a common 0-5 scale. To balance the distribution of each score, a standard deviation (or Z-score) was calculated to determine how each firm’s score compared to the average score of the information source. The Z-scores were then used to create a standardized U.S. News score in the manner outlined below:

Calculation of the Z-Score: The Z-Score represents the relationship of the data points to the average measure of the data set; the Z-Score is negative if the data points are below the average, positive if they are above, and a Z-Score of 0 means equal to the average. To determine the Z-Score for each third-party agency’s corporate rating, we calculated the average of all corporate and agency ratings evaluated by that third-party source. The Z-Score was then calculated by subtracting the mean from the company’s rating and dividing by the standard deviation.

T-Score Calculation The T-score calculation was performed by multiplying the Z-score by 10 and converting it to a scale of 0 to 100. An adjusted T-Score was created by adding the desired scoring mean (between 0 and 10) to the T-Score so that the mean was equal for all data points.

Calculation of Common Scale Rating The 100-point adjusted T-Score was divided by 20 to convert the third-party ratings into a common rating on a scale of 0 to 5.

(c) A 360 overall score was calculated based on a weighted average model.

Each source used in the consensus scoring model was assigned a “source weight” based on its rating of how trusted and recognized it is by consumers and how comprehensive and editorially independent the review process it publishes is. were assigned. Source weights are rated on a 5-point scale from 1 to 5. Sources with a weighting of less than 2 were excluded from the consensus scoring model.

Finally, a weighted average formula based on source weights was used to combine the transformed third-party data points. This formula yielded a consensus score for each product, which we refer to as the “360 Overall Rating.”